After a long period of COVID-19 forbearance and eviction moratoriums, some Illinois homeowners are facing foreclosures from their homes. There have been no significant changes to Illinois foreclosure law for 2024. This article will briefly review the Illinois foreclosure process. Learn more about your rights in the event of a foreclosure and what you can expect if you are facing one in this article.

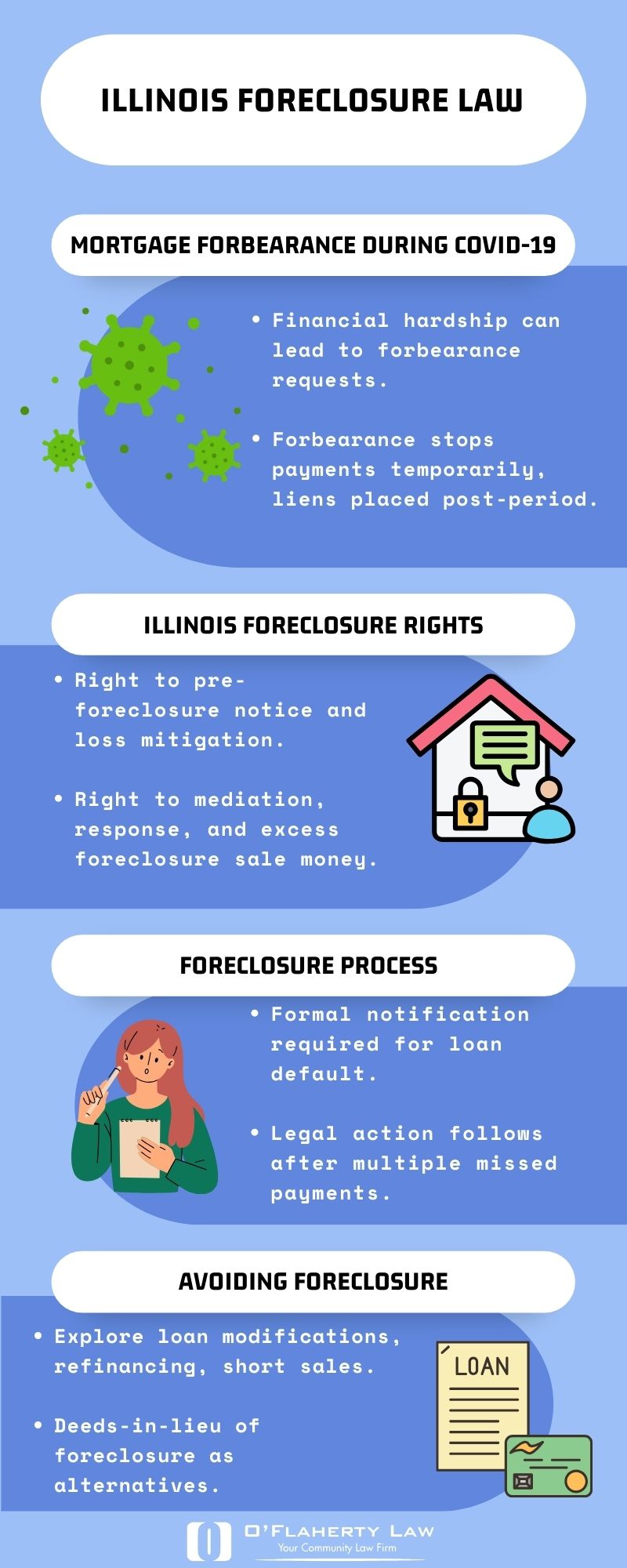

Mortgage Forbearance And the COVID-19 Pandemic

As the COVID-19 pandemic rages on, many continue to face financial impacts, especially homeowners with federally backed mortgages. Borrowers can reach out to their lenders if their mortgage is backed by a federal loan such as FHA and request a forbearance. The process for requesting a forbearance is as such:

- A borrower falls into financial difficulty due to the pandemic and cannot make payments on their home.

- The borrower then fills out paperwork to file for forbearance.

- Once the forbearance is approved, they are not required to make payments for the period of forbearance.

- After the forbearance period ends, the money owed is placed as a lien on the real property second in priority to the primary mortgage.

It is also possible for your rental property to go into foreclosure. If this happens, it may affect your lease.

During An Illinois Foreclosure, You Have The Right To:

- Receive a pre-foreclosure notice called a breach letter

- Right to apply loss mitigation

- Right to participate in mediation

- Right to receive notice of the foreclosure and the chance to respond to the foreclosure in court

- Right to pay off the loan balance to avoid a foreclosure sale

- Right to receive special protection if you are in the military

- Right to receive the excess money after the foreclosure sale

- Right to redeem the property after the sale. In Illinois, you can redeem the property up to 30 days after the judicial sale. Mortgage borrowers will have a right to redemption of the mortgage if:

- The purchaser at the sheriff's sale was a mortgagee that was a party to the foreclosure case

- The judicial sale price is less than the total amount required to redeem the mortgage.

Suppose the mortgage borrower exercises their right to bail. In this case, they must pay the judicial sales price and all costs accumulated by the mortgage lender, which is located in the sale and confirmed by the court. They must also pay all statutory judgment interest from the time of purchase.

Learn more about judicial foreclosures in our article, Judicial vs. Non-Judicial Foreclosures.

What is a Default?

A default on the mortgage loan payment means that there has been a failure to abide by the terms of the mortgage or other relevant mortgage loan documentation. Default can occur in many ways, but usually, default will commence when a mortgage borrower fails to make required monthly payments.

Initially, default is identified in the foreclosure complaint on the real property. When borrowers fail to make a second monthly payment, they are notified by the mortgage loan provider of the default. The borrower then has 30 days to contact a housing counselor. The borrower will receive a second 30-day grace period before legal action. After missing three monthly payments, the borrower is given notice of acceleration. The notice informs the borrower that the property is set for foreclosure. Documentation is sent to an attorney to initiate the foreclosure proceedings.

It is important to note that there are many benefits to working with a foreclosure defense attorney when facing a foreclosure in Illinois.

What is Pre-Foreclosure?

In Illinois, pre-foreclosure is the period where you get behind on your mortgage payments but before a foreclosure begins. During this time, the mortgagor can charge you the mortgagee fees, late fees, inspection fees and will send you a breach letter. Usually, when you first fall behind on payments, you have a grace period of 10 to 15 days. After that, you are charged a late fee. It would be best if you looked at your promissory note to see your rights and options at this point in the foreclosure process.

Breach Letters and Demand Letters

In Illinois, most mortgage agreements contain clauses that require mortgage lenders to notify borrowers that a loan is in default status before taking legal action. The formal notification for this is called a breach or demand letter. A breach letter must include the following:

- Notification of the loan default and the reasoning behind the loan default

- The solution that will resolve the loan default

- A deadline for resolving the loan default (usually 30 days from the date of the letter)

- Notice that failure to remedy the default will result in the acceleration clause (to be activated in the loan and the possible sale of the real property)

If the defaulted mortgage issue is not addressed, the lender may file a foreclosure action with the court. This is usually filed in the county where the property is located, but foreclosures can also be filed in Federal Courts.

Foreclosure in Illinois

The foreclosure court proceedings will commence when the lender has filed a complaint. The mortgage borrower is served a copy of the summons and complaint, along with a notice of rights. In most cases, the mortgage borrower has 30 days to file the response to the complaint. If the borrower fails to respond, this will result in a default judgment for the lender.

In Illinois, there is a period known as a redemption period. You, as the borrower, have a legal right to pay off all that is due and owed on the mortgage. The real property cannot be sold during the redemption period.

The Sale and Eviction

Before the foreclosed home can be sold, a notice must be published in the local newspaper for at least three consecutive weeks. You are given notification by mail ten days before the sale. At the foreclosure sale, the real property may be sold to the highest bidder or may even be sold back to the lender. Suppose the remaining debt is more than the amount you owe. In that case, the mortgage lender may seek to collect a deficiency judgment against you.

Confirmation of Foreclosure Sale

After the judicial sale occurs, the lender then files a motion with the court to confirm the judicial sale; the court must then confirm the sale unless it finds that:

The notice of the sale was not given, or improper notice of the sale was given. Proper notice of sale must be given to all parties in the foreclosure action who have appeared or have not been found in default for failure to plead. Notice of sale of the home must be continuously published in a newspaper for at least three weeks.

- The terms of the sale were unconscionable.

- The sale was fraudulently conducted.

- That justice was not carried out.

- An eviction order will be entered and stayed for 30 days. Personal liability for any deficiency is established when the property sells for $200K, but the borrower owes $250K.

Defenses to Foreclosure

There may or may not be defenses available to you as the mortgage borrower in a foreclosure action that the mortgage lender files against you. The mortgage loan documents and foreclosure complaint must be analyzed very closely to determine whether or not there are any defenses available to you as the mortgage borrower.

Standing - If standing is not raised correctly, it will be waived. The mortgage loan document must be reviewed to determine if a plaintiff (the mortgage lender) has the standing to pursue the mortgage foreclosure action against the mortgage borrower.

Illinois Consumer Fraud and Deceptive Businesses Practices Act - the ICFA allows an injured party to recover for violations of the Act. You must review the ICFA to see if there are any violations of the ICFA for deceptive conduct by the mortgage lender. You can read the ICFA in its entirety.

The Real Estate Settlement Procedures Act - this governs the process for notice of transferring a mortgage, maintaining escrow accounts, applying for mortgage payments, notices of error, and loss mitigation procedures.

The Truth-in-Lending Act and HOEPA violations - the TILA and HOEPA have protections that may be raised as a defense. The mortgage can be voided as long as the mortgage is a non-purchase money mortgage. This is available for only three years after the mortgage is successfully executed. Failure to disclose material terms of the mortgage in-writing or high-interest rates on a non-purchase money mortgage may indicate a violation of TILA or HOEPA. The Lawyer for the mortgage borrower should view the original disclosure documentation to see if there was a violation of TILA or HOEPA.

Fair Debt Collections Practices Act - people or institutions who file a foreclosure complaint must comply with the FDCPA. If there are violations of the FDCPA, this may give rise to a claim for damages against the mortgage lender.

Fair Credit Reporting Act - The failure to accurately report or update a mortgage borrower's credit report may give the mortgage borrower rights to bring claims under the FCRA and collect damages against the mortgage lender.

FHA Backed Mortgage Loans - FHA loans give broader protections to mortgage borrowers facing issues paying their mortgage. FHA has special servicing requirements which require a counseling notice to be mailed to the mortgage borrower 45 days after defaulting on the mortgage loan. Mortgage lenders must have an in-person meeting with the mortgage borrower before three missed mortgage payments. The mortgage lender must give the mortgage borrower counseling services about the mortgage loan. Suppose the mortgage lender fails to give the mortgage borrower the opportunities mentioned above. In that case, this will be an affirmative defense to the foreclosure brought by the mortgage lender upon the mortgage borrower.

Failure to Attach Note and Mortgage to the Complaint - If the note and mortgage are not attached to the foreclosure complaint, the mortgage lender's foreclosure complaint is subject to a motion to strike. Most Illinois courts will allow a mortgage lender to cure the lack of note and mortgage without striking the complaint.

Breach of Contract - If the mortgage lender fails to follow and uphold the mortgage contract terms, a mortgage borrower may claim a breach of contract against the mortgage lender. This may arise when the mortgage loan provider fails to apply for payments in the mortgage's order.

Breach of the Covenant of Good Faith and Fair Dealing - every contract contains a covenant of good faith and fair dealing in Illinois. It can be used when the mortgage provider does not uphold the mortgage contract terms and acts in bad faith. If a mortgage borrower can prove that this covenant is breached, they may recover damages.

Incorrect Notice or Service - If the mortgage borrower is not given proper notice of the foreclosure, the notice or service may be defective and attacked by the mortgage borrower. All information in the notice must be accurate; there cannot be errors in the notice of motion for foreclosure. All documents must be served electronically. Emails must be sent to a mortgage borrower's preferred email address or the email address of the mortgage borrower's attorney.

Failure to Accelerate the Note - the loan must be accelerated, or the mortgage loan cannot be foreclosed. If the mortgage loan documents require notice because the acceleration of the mortgage failure to send notice may defeat the foreclosure.

Tax Sale - The buyer should not have to pay any increased costs or fees if the real estate taxes are unpaid and sold. Suppose the buyer made timely mortgage and escrow payments and responded to mortgage lender inquiries. In that case, the buyer should not have to pay more in fees and costs.

Suit After Assumption - if the original mortgagor sells the property and does not get a release from the mortgage, they will still face liability in a foreclosure action against them. The original mortgagor should be dismissed from the lawsuit without any adverse consequences that will affect their credit.

Fraud or Abuse - If the mortgage lender gives the mortgage borrower a abusive, fraudulent, or coercive loan, it may be possible for the mortgage borrower to raise fraud as a defense to foreclosure.

Mortgage Lender Accepting Payments After Filing Foreclosure - if the Mortgage lender continues to accept payments from the mortgage borrower after they filed for foreclosure and if the mortgage borrower is not in current bankruptcy proceedings, the mortgage borrower may have a defense to the foreclosure.

Strategies to Avoid Foreclosure in Illinois

Despite the seeming inevitability of foreclosure after missing mortgage payments, homeowners have several strategies at their disposal to prevent it. Employing these strategies could aid homeowners in managing their financial predicaments and possibly keeping their homes.

Homeowners can explore the following strategies:

- Loan modifications

- Refinancing

- Short sales

- Deeds-in-lieu of foreclosure

Each of these options has its own advantages and disadvantages, and the best strategy will depend on the homeowner’s specific circumstances.

Loan Modifications and Refinancing

Loan modifications and refinancing are two strategies that can help homeowners avoid foreclosure by adjusting the terms of their mortgage. In a loan modification, the mortgage lender agrees to change the terms of the loan, such as reducing the interest rate, to make the payments more manageable for the homeowner.

Refinancing involves replacing the existing loan with a new one, usually with a lower interest rate or a longer repayment term. This can lower the monthly mortgage payment, making it more manageable for the homeowner. However, refinancing during foreclosure can be challenging due to the negative impact on the homeowner’s credit score.

Short Sales and Deeds-in-Lieu

Short sales and deeds-in-lieu of foreclosure are other strategies that homeowners can consider to avoid foreclosure. In a short sale, the homeowner sells the property for less than the outstanding mortgage balance. The lender agrees to accept the proceeds from the sale and forgive the remaining debt.

A deed-in-lieu of foreclosure involves the homeowner voluntarily transferring the ownership of the property to the lender to avoid the foreclosure process. This strategy can be beneficial for homeowners who are unable to sell their home or pursue a loan modification. However, homeowners should be aware of the potential tax implications of these strategies.

Seeking Help from Foreclosure Professionals

For homeowners, navigating the intricate web of foreclosure laws and processes can be overwhelming. Therefore, seeking help from foreclosure professionals can provide valuable guidance and support. These professionals can help homeowners understand their rights, explore potential defenses, and negotiate with lenders on their behalf.

Foreclosure professionals, such as qualified attorneys and HUD-approved housing counselors, have the knowledge and experience to guide homeowners through the foreclosure process. They can provide homeowners with the necessary tools and information to make informed decisions and potentially avoid foreclosure.

Finding a Qualified Foreclosure Attorney

Hiring a qualified foreclosure attorney can be a game-changer for homeowners facing foreclosure. A proficient foreclosure attorney can:

- Assist homeowners in navigating the legal process

- Identify potential defenses

- Negotiate with lenders on their behalf

- Serve as advocates to resolve situations in the homeowner’s best interest.

When choosing a foreclosure attorney, homeowners should ensure they look for the following qualifications:

- Hold a law degree from an ABA-accredited law school

- Licensed to practice law in the relevant state (e.g. Illinois)

- Maintain good standing with the bar

- Have significant experience in foreclosure law

Summary

In conclusion, understanding the foreclosure laws and processes in Illinois is crucial for homeowners facing potential foreclosure. With the recent changes due to the COVID-19 pandemic and state regulations, the landscape of foreclosure laws has become more complex. Despite the complexities, homeowners have various strategies and resources at their disposal to avoid foreclosure and protect their homes. Professional help, such as foreclosure attorneys and HUD-approved housing counselors, can provide valuable guidance and support throughout the process.

Frequently Asked Questions

How long do you have to move out after foreclosure auction in Illinois?

In Illinois, after a foreclosure auction, you will typically have 30 days to move out. It's important to vacate the property within this timeframe to avoid being removed by the sheriff.

How many mortgage payments can you miss before foreclosure in Illinois?

In Illinois, missing 120 days of mortgage payments can lead to foreclosure proceedings initiated by the lender. It's important to address any missed payments as soon as possible to avoid the risk of foreclosure.

How long does the foreclosure process take in Illinois?

The foreclosure process in Illinois typically takes around 12-15 months to be completed.

Are foreclosures up in Illinois?

Yes, foreclosures in Illinois have surged, with the state having the highest foreclosure rate in the nation last year, at 1 in every 762 homes. This trend has been accelerated by the expiration of measures intended to keep people in their homes.

What is the foreclosure law in Illinois?

In Illinois, if you miss several payments and reach 90 days of delinquency, your loan may be considered in default, and foreclosure proceedings can be initiated by the lender after 120 days of delinquency.

If you need assistance in your foreclosure matters, please contact our foreclosure defense team today. Give us a call at (630)-324-6666 or fill out our confidential contact form, and a member of our team will be in touch.

.jpg)